Adapting to Germany’s E-Invoicing Compliance

The new e-invoicing mandate in Germany marks a major shift for hospitality businesses, driven by the European Union’s directive to standardise electronic invoicing in business to business procurement. Designed to streamline processes and reduce administrative burdens across member states, this regulation will affect how invoices are issued, processed, and archived—bringing both challenges and exciting opportunities for the hospitality sector. Here's a look at what this shift means and how it can enhance operations and guest experiences.

For hotels and other hospitality businesses, compliance will require all invoices to be issued in a specific structured electronic format. The mandate isn’t just about using digital invoices but also adopting formats like ZUGFeRD or XRechnung, which meet the European standard (DIN EN 16931). These formats are designed to be automatically processed by both public and private sector systems, allowing seamless integration with other financial processes. Ensuring your invoicing software is compatible with these formats will be essential for maintaining compliance and avoiding operational hiccups.

The switch to e-invoicing demands more than a change in format—it requires a new approach to financial data management. Each e-invoice must include specific data elements such as VAT numbers, invoice dates, unique identifiers, and itemised descriptions of services. This shift creates an opportunity for hospitality businesses to bring greater accuracy and consistency to their billing and record-keeping practices, which can help streamline accounting and support audits more effectively. And since data security is now central to compliance, it’s essential to adopt secure transmission channels and digital signatures to ensure data integrity.

Future-proofing business operations

E-invoicing isn’t just about compliance—it’s a way to future-proof your business operations. The mandate encourages hospitality leaders to adopt smart digital archiving solutions, as e-invoices will need to be stored for a minimum of ten years. For many hospitality executives, this offers a chance to create a more robust digital framework, where invoices are not only archived securely but also easily retrievable for audit purposes. And with advanced archiving solutions in place, businesses will save time and reduce risks when faced with compliance checks.

Practical benefits for the hospitality industry

Transitioning to e-invoicing presents practical benefits for the hospitality industry beyond legal adherence. A digitised invoicing system brings the promise of enhanced efficiency, real-time data exchange, and improved accuracy, which can lead to better financial insights and more informed decision-making. For hotels, e-invoicing means a reduction in paper waste as part of more sustainable business operations, which guests are generally in favour of. In an industry where speed and accuracy are crucial, e-invoicing can be an unexpected advantage, streamlining internal workflows and reinforcing your reputation as a modern, guest-focused brand.

Of course, non-compliance carries risks, including financial penalties and potential damage to a brand’s reputation. Germany’s new regulations require hospitality businesses to prepare before the final compliance deadline in January 2025. Large businesses may face earlier timelines, so staying informed about specific deadlines will be essential to avoid fines or operational disruptions.

Compliance, integration and insights

Choosing the right e-invoicing software is a critical step in ensuring a smooth transition. A solution like FutureLog is designed specifically for hospitality and addresses all compliance needs, from secure data handling to format compatibility with Germany’s e-invoicing standards. FutureLog integrates with property management systems, simplifying workflows for busy hospitality teams. By adopting a comprehensive e-invoicing solution, hospitality leaders can not only achieve compliance but also gain powerful insights into their expenditure and financial performance.

Germany’s e-invoicing regulation brings a significant change, yet it also opens the door to more efficient, accurate, and ultimately more guest-friendly operations. For hospitality executives, adapting to this regulation means staying competitive, boosting operational efficiency, and enhancing guest satisfaction—ultimately turning compliance into a valuable advantage.

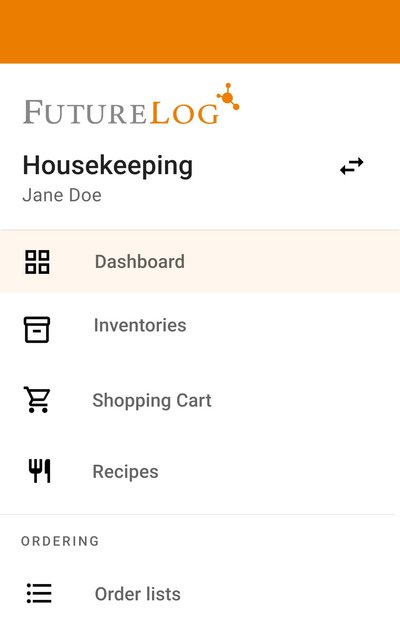

OUR APP: Procure-to-pay while on the go!

From placing orders and managing recipes to approving invoices and viewing reports, with FutureLog’s native mobile app you’ll have all the power and automation of our P2P web solutions conveniently at your fingertips. Whether you’re online or offline, you can stay in control.