Reducing Procurement Fraud Risk in Hospitality With Procure-to-Pay Automation

When it comes to fraud risk, one area of particular concern is procurement. In recent years, hotels have faced myriad challenges, including supply chain disruptions, economic volatility, and labour shortages. As travel volumes rebound, many hotels are concentrated on meeting evolving consumer expectations while ensuring financial stability. This focus means that many hotels are lacking in their procurement due diligence, creating lucrative opportunities for fraudsters. It’s estimated that hotels lose between 5% and 6% of their annual revenue due to fraud.

Unless you have the right systems and controls in place, procurement-targeted fraud could be hiding in plain sight within your organisation. Left undetected, these activities can have severe financial implications, both in direct losses and indirect costs from investigations, regulatory fines, and remediation. Fraud events can also damage your reputation and guest loyalty, resulting in significant revenue losses over time.

While procurement fraud is on the rise, sophisticated procure-to-pay (P2P) solutions are an effective way to protect your business’s supply chain from nefarious activity.

Evolving procurement fraud risks and regulatory standards

In 2022, the Association of Certified Fraud Examiners (ACFE) found that mean fraud damages in the food service and hospitality sector were $579,000. Researchers suggest that hospitality is at a higher risk of fraud than other industries, particularly because hotel supply chains tend to be more expansive and labour-intensive, creating more areas of exposure.

Additionally, many hotels still rely on manual, paper-based processes throughout the procurement cycle. In fact, close to 90% of small to midsize businesses still use physical or PDF invoicing. These outdated systems have more manual touchpoints capable of exposing confidential information. They also make implementing consistent and comprehensive controls harder, making hotels more vulnerable.

In the UK, procurement fraud has risen by 13% in the last year. As businesses and individuals struggle to navigate inflation and cost pressures, many may be incentivised to commit fraud against hotel buyers or employers. Additionally, the growth and sophistication of cyber criminals pose a greater threat to hotel procurement functions. In September 2023, a cyber attack targeting MGM Resorts International cost the business over $100 million.

How are hotel procurement systems targeted? Insiders or external suppliers may attempt to submit fraudulent purchase orders (POs) for financial gain. This can be accomplished by manipulating the pricing, order frequency, or item descriptions on POs. Some fraudsters may split large orders between multiple POs, which can be hard to flag if the resulting amounts are below your hotel’s procurement control thresholds. Insiders may also attempt to manipulate accounting records - for example, by inflating the quantity of acquired goods.

Illegal price fixing, when vendors unfairly raise prices to reduce competition, is common. Suppliers may engage in kickback schemes, which involve bribery in exchange for preferred treatment. Procurement fraud could also simply mean that suppliers intentionally underdeliver on the agreed quantity of goods or services that your hotel paid for.

In the UK, the Financial Reporting Council (FRC) announced hospitality as a priority sector for audit inspections in 2023 and 2024, with a focus on fraud risk monitoring. FRC priority sectors are those that carry exceptionally high risks and may experience greater scrutiny and financial penalties for noncompliance. If the potential for fraud losses and eroded consumer trust wasn’t already enough of a motivator, this regulatory environment is pushing hoteliers to invest in sufficient fraud controls for procurement.

A proactive approach to procurement fraud

Human analysis alone can’t accurately identify errors, mismatched information, and other red flags throughout the hotel procurement process, especially at scale. Automating the procure-to-pay cycle through sophisticated software eliminates the need for these manual, fraud-prone tasks and makes procurement transactions more transparent and secure.

For example, P2P software consolidates a hotel’s purchasing activities and allows procurement teams to automate stricter approval workflows across them. This facilitates approval consistency and ensures that only a select few authorised personnel can initiate and approve purchases.

Additionally, these platforms house comprehensive databases of your approved vendors. Procurement professionals then have easy access to vendor contact information, certifications, and performance history insights — such as delivery timelines, order accuracy, and contract compliance. Being able to verify vendor credentials and keep a transparent record of their activities empowers hotels to prioritise reputable suppliers and avoid partnering with those that carry greater risks.

Automated P2P systems also allow hotels to reduce or eliminate paper-based practices by enabling electronic PO, invoicing, and payment practices. Digitising these activities reduces errors and the potential for manual manipulation, and makes it easier to trace procurement transactions more accurately. For instance, P2P systems can automate three-way matching to prevent fraudulent practices like double billing.

P2P automation further benefits hoteliers when they are supported by advanced data analytics and artificial intelligence. Procurement professionals can use these features to monitor transactions in real time and identify suspicious patterns or anomalies that could indicate fraud. Rather than reacting to incidents after they’ve already escalated—in some cases, for many days, weeks, or months—hotels can respond proactively. Early detection and response are more likely to minimise financial and reputational repercussions while making it easier to investigate and resolve issues. Industry research has shown that anti-fraud controls, including proactive analytics, can improve fraud detection speeds by up to 50% and reduce losses by 54%.

Stay secure with a Procure-to-Pay platform built for hospitality

These capabilities all point to greater procurement transparency and controls, reliable vendor relationships, and more proactive risk detection and management for hoteliers. A preventative approach is the best thing hotels can do to address procurement-targeted fraud, especially when recovering funds and regaining trust from guests, stakeholders, and regulators isn’t always possible and can take many years.

If your hotel has experienced or is susceptible to procurement fraud, a P2P automation system is a prudent investment to remain secure and compliant as risks evolve. P2P platforms designed specifically for the hospitality industry, such as FutureLog, can further optimise your spend function while reducing fraud risks, errors, and noncompliance.

About FutureLog

FutureLog provides a fully integrated, cloud-based procure-to-pay platform for the hospitality industry. We facilitate an end-to-end procurement process from purchasing, through inventory management and up to invoice processing; all available in one platform to save you time and money. The FutureLog procure-to-pay platform is the foundation for seamless connectivity between Hotel Operations, Corporate Centres and Suppliers.

Suzanne Ward

Vice President Digital Marketing and Communication

+41 41 759 1861

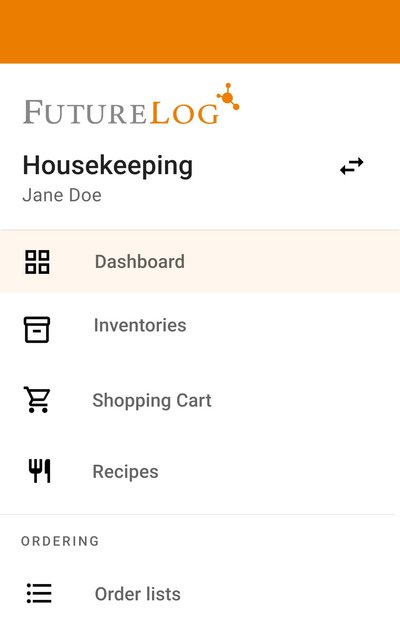

OUR APP: Procure-to-pay while on the go!

From placing orders and managing recipes to approving invoices and viewing reports, with FutureLog’s native mobile app you’ll have all the power and automation of our P2P web solutions conveniently at your fingertips. Whether you’re online or offline, you can stay in control.